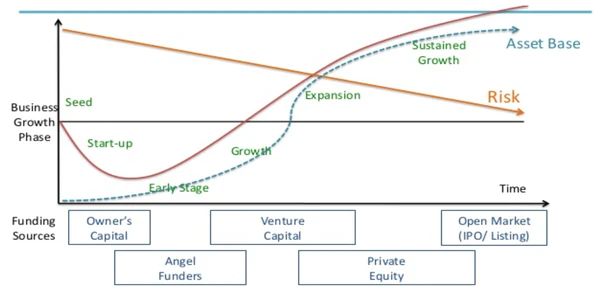

One of the main challenges for early-stage businesses in South Africa is access to funding. This is not as a result of a lack of available finance but rather due to a range of issues, including, but not limited to, regulations, complex finance application processes, and the economic climate. An important component to successfully financing your business’s growth is identifying what strategy is the most suitable for both you as the owner and for your business.

The following types of funding may be worthy considerations in determining how you are going to fund your next business concept or unlock growth in an existing business.

1. Angel Investors

An angel investor is a wealthy individual that provides funding in exchange for equity in the business. The investment may be made by a single investor or a group of investors that invest their personal finance in the growth of the business. These types of investors are referred to as ‘angels’ because they are willing to invest their personal funds into a higher risk business when no one else will.

Advantages

- The right investor may have a more hands-on approach and provide value with relevant industry experience.

- Private investors can react faster to ad hoc challenges and a changing business environment.

- The investor may be ‘well-connected’ and introduce you to new opportunities.

- The pace of the transaction from beginning to end is quicker.

Disadvantages

- Emphasis must be on identifying an investor that is a ‘good fit’ for the business to avoid unhealthy business relationships.

- The inclusion of such an investor may make it seem as if you have lost an element of control.

- The investment opportunity will need to be one of high growth in order to attract such an investor.

2. Venture Capital

Venture capital is focused on early-stage businesses with high-growth potential. Funding is provided by a venture capital company or fund. There are more defined timelines with venture capital, in that, the venture capital company or fund invests in businesses with the intention of selling their stake for a profit after a certain period of time.

Advantages

- The investment sizes are generally larger than investments made by angel investors.

- Access to a network of investors with good business acumen.

- Growth focused investors driving the performance of the business.

- Seek a minority stake in the business (in most cases).

- Opportunity to approach the venture capital company for additional funding rounds in exchange for more equity in the business.

Disadvantages

- Increased pressure to meet performance targets. The venture capital company will maintain a watchful eye over the performance of the business and exercise pressure if financial performance is not satisfactory.

- Difficult to meet the high-growth requirements needed to convince the venture capital company or fund that your business is investment worthy.

- Strong competition from other businesses for obtaining venture capital funding.

- Loss of control in strategic business decision making.

3. Private Equity

A private equity company or fund is money pooled from a group of investors with the purpose of investing it in investment-ready businesses that make for a promising investment opportunity. This usually involves an entire private equity firm and a group of people whose focus is to help the business grow. Private equity, in comparison to venture capital, is aimed at more developed businesses, that have been trading for a longer period of time and as a result, the investment is considered less risky in nature.

Advantages

- Access to a pool of investors with high expertise and sought after business acumen.

- Relationships with private equity companies can be a driver of high growth.

- Private equity deals provide large sums of funding.

- Here the investor has a lot at stake (a lot of ‘skin in the game’) and is generally well incentivised to ensure that the business grows.

Disadvantages

- Private equity funds usually invest with the intention of exiting after a period of time for a profit. The focus on the value that can be derived from the business is primarily in terms of profit.

- It is unlikely that a private equity company will be looking for a minority stake – they usually seek a controlling stake and want to dictate how the business should be run.

- The process of convincing the private equity company that this is a sound investment is likely to be time-consuming.

4. Debt Financing

Debt financiers may be able to assist with raising finance. In return for lending the money, the financier receives a promise to have the principal and interest repaid at an agreed future date.

Advantages

- No equity is given-up.

- Debt has a defined end (once you repay the total amount borrowed). Equity is indefinite in the sense that the investor will own a portion of your business.

- You are not required to report to a group of investors regarding the performance of the business.

- The financier doesn’t dictate business strategy or how the business should be run (all aspects of control are maintained).

Disadvantages

- Lack of assistance from a person or group of people with good business acumen and high levels of expertise.

- Collateral will need to be provided to secure the loan.

- Lengthy and stringent application process.

5. Equity Funding through Private Network

Business owners approach their private network (referred to in the industry as ‘friends, family or fools’) for funding in exchange for equity in the business. A private campaign differs from a campaign by way of a public offering in the sense that the investment opportunity cannot be offered to members of the public – the offer can only be communicated to a private group of investors. For example, emailing a defined group of investors in your network.

Advantages

- Administratively less burdensome than an offer to the public.

- Less compliance surrounding company structure than with the inclusion of a public company.

- Formation of a business relationship with a group of people that are in your private network rather than people from the general public.

- The pace of the transaction from beginning to end is quicker than with a public offer.

Disadvantages

- One must be cautious regarding legislative requirements defining private offers and public offers.

- Loss of publicity and the ‘hype’ associated with an offer made to the public.

- Reliance on responsiveness from investors before one can discuss the investment opportunity in detail.

- Your ‘reach’ in terms of the number of investors that you may contact is limited to your private network.

5. Equity Crowdfunding (Public Offering)

This is not your most traditional method of raising finance, however, equity crowdfunding is a topic that is receiving a lot of attention of late. The investment opportunity is not limited to a private group of people, the ‘crowd’ is much larger in the sense that the offer is made to the public. Businesses that have a large number of followers offer their ‘crowd’ ownership in their business. For the investor, the transaction may be more of an emotional one in that they want to support the business and see the brand succeed.

Advantages

- Sell a piece of your business directly to your audience. Your customers hold equity in your business.

- Added marketing benefits associated with a successful campaign.

- Psychological influence of the ‘bandwagon effect’ – potential investors are excited by the investments that have already been committed.

- Control of strategic decision making is maintained – a large number of people own a small portion of the business, rather than one or two investors dictating how the business should be managed.

Disadvantages

- Limited track record in South Africa.

- Stringent regulation surrounding offers to the public.

- Time-consuming and administratively intense.

- Where a campaign does not reach the intended target, the funds raised must be returned to the investors.

In a South African context, where SMEs really can be the drivers of improved economic performance, the question, “how can early-stage business owners grow their business”, is all the more prevalent. If you are a business owner, you are fortunate in the sense that there are various options available to you. The strategy that you choose to adopt will largely determine whether you are successful or not, and more importantly whether you enjoy the process along the way.

If you have any questions or require support in determining how best to raise funding, please schedule a call.