The cash flow statement is the final piece of the puzzle when it comes to the monthly management reports that we prepare here at Creative CFO. This is without a doubt one of the most important and often overlooked financial reports within the monthly report pack.

The cash flow statement in context

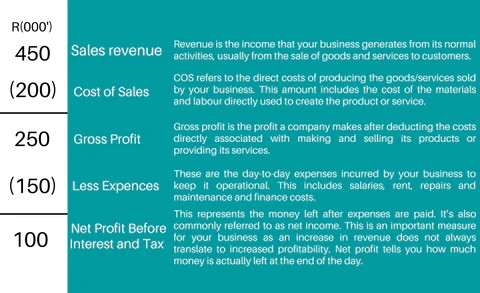

The profit and loss statement, discussed in an earlier blog, provides information on the revenue and expenses over a certain period of time. This is used alongside the balance sheet, which gives a snapshot of the financial health of a business. Out of the information from both of these reports, the cash flow statement is born.

Cash is the heartbeat of a business. A business requires cash to be able to pay its suppliers, vendors and employees, but it also needs cash to be able to invest back into itself in order to grow. The cash flow statement can show how effectively a business is managing its cash inflows and outflows over a specified period of time. This is particularly important to investors seeking to determine the short-term viability of your company, particularly its ability to generate cash and pay bills.

In accounting terminology we often refer to “accrual versus cash accounting”, and this really sums up the importance of understanding the cash flow statement and how it can be utilized to grow your business. “Accrual versus cash” refers to the method in which a report is drawn up. Accrual accounting reports on revenue when it is earned and expenses when they are incurred. Generally, your profit and loss statement is drawn up on the accrual basis. This means that you could earn revenue by invoicing your customers and this will reflect on your profit and loss statement, but until cash changes hands and you receive the money in your bank account, it will not increase your cash immediately. In essence, profits do not always equal cash.

When we look at our monthly reports, it is common to go straight to the balance sheet to see what the bank balance was at month end. However, it does not necessarily tell you how it came in or went out during the month.

Breakdown of the cash flow statement

Let’s take a closer look at the components that make up a typical cash flow statement by using the example below.

Based on the indirect cash flow method, we will start with the operating profit/loss which is pulled directly from the profit and loss statement. This is then adjusted to take into consideration non-cash movements, as well as cash movements, to reconcile at the end of the report with the actual cash balance that you have in the bank at a specific month end.

Depreciation and amortisation are always adjusted for, i.e. added back, as no physical cash leaves the business for these transactions. The only time that cash is affected is when we actually buy the asset. Depreciation and amortisation simply show how the expense is allocated over its useful life.

We can then split the rest of the report into three main sections:

1. Cash generated from operations

This is such an important section of the cash flow report as it showcases how the core of your business is generating and utilizing cash. If we take a look at the movements that are represented in the above image, we can establish how these movements affect the amount of money we have in the bank.

For example, if we take a look at the (increase)/decrease in trade debtors – this would be your customers whom you have invoiced, and if this figure increases then we adjust the net income by deducting the increase, and if it decreases, we adjust with a positive figure.

At the end of the cash flow from operations, you ideally want to see a positive number here, otherwise the company is not raising its cash from its core business activities which could raise a couple of red flags. One of the most common causes of this could be that your cash is tied up – you are perhaps giving your customers long payment terms or your receivables are very overdue – which means you have to continue paying your expenses and suppliers before you have actually received the cash from your customers.

2. Net cash from investment activities

This is cash spent or received from investments, which is outside the core of the business. If you perhaps purchase a new asset or purchase shares in another company this will be reflected here.

3. Net cash from financing activities

This represents the raising, borrowing or repaying of loans and issuing of new shares or dividends paid, to name a few. If you receive a loan from the bank, the cash comes in, so this will be represented as a positive amount on the cash flow statement. This is then easily identifiable to the person reading the report that money has come in. When the company repays the principal portion of its loans, this will be presented as a negative amount, which means that cash was used which reduces the bank balance.

Managing cash flow is vital for business success, it really can be summarized as doing anything and everything possible to ensure money is coming into the business as quickly as possible and exiting as slowly as possible. In order to summarise the cash flow statement visually we use the waterfall representation as part of the monthly management reports, an example of which is below.

Tips for getting the most out of your cash flow statement

To end off, we will leave you with a few of our top tips to keep in mind for when you are next reviewing your cash flow statement and forecasting for the upcoming months:

- Profit does not equal cash, so don’t count income until it’s in the bank.

- Plan for the unexpected. Before you purchase that awesome new coffee machine, make sure you have cash in the bank to cover at least two months’ operating expenses.

- Be prepared for growth. When a business grows, it more often than not comes with additional costs which can include marketing, buying additional inventory or on-boarding additional resources.

- Line up your invoicing and collections. Too many small businesses land up with customers with long outstanding debts. Make sure to stay on top of your debtors or implement a debit order system from the start.

- Always have an up-to-date cash flow forecast. It is vital to know what your cash commitments are for the upcoming year.

The cash flow statement is one of the most integral components of the monthly management report pack that Creative CFO provides. Now that you know what it means to have an up-to-date cash flow statement, get in touch with us to discuss your business’s financial reporting needs.