When working remotely one needs to put more effort and structure into coordinating teamwork, and ensuring each person can ask for help and get the support they need.

You won’t be able to quickly walk over and ask for help or see that someone is struggling and needs a hand.

Regular catchups, with a good meeting structure, go a long way to ensuring that all team members have the opportunity to:

- Check-in on how they are doing.

- Share their work updates.

- Raise any key roadblocks they need support on.

- Work out their issues with the team.

For operational catchups, our team broadly uses the Holacracy tactical meeting format. We use this in conjunction with our task management software, Asana.

Here’s how we do it:

- Meeting schedule:

- Team meetings are scheduled twice a week on a Monday and Friday, for a duration of 30 minutes.

- This is designed for 4-6 people, but you may need to book out a slightly longer timeslot as you are getting used to the format, or if you have a bigger team.

- The first meeting of the week is more about tasks and co-ordination.

- The second meeting is more of check-in and updates, but both should stick to the meeting format outlined below.

- Meeting roles:

- A facilitator is needed to run the meeting and is appointed to make any notes or create tasks that arise from agenda items.

- Everyone else represents their role(s).

- Meeting format:

- Follow the below format closely, or develop your own version, but do always follow a flow to ensure all team members know how to, and can, contribute.

Meeting Format

1. Welcome

The facilitator welcomes everyone to the meeting, notes apologies of team members that couldn’t make it and confirms the time allocated for the meeting.

They can also check if anyone needs to leave early, and make a note of that so everyone is aware.

2. Opening round (1-way)

The opening check-in round is a 1-way flow where only one team member speaks, without discussion.

*Tip: It is best to have laptop screens down and phones away.

Nothing is formally required beyond a ‘hello’, but it is an opportunity for each team member to share how they are doing, what’s on their mind and to get present for the meeting.

It is not a discussion time, no sympathy or praise required, just a few moments to let your team know how your day or weekend went prior to you arriving at the meeting, to give them context for your overall mood and to get ready to make the most of the team time ahead.

As an alternative, some teams do 30 seconds of silence to help get present.

3. Checklist review (no discussion)

The facilitator asks everyone to review their tasks in Asana and make sure there is ‘no-task-left-behind.’ The team has about 60-120 seconds to do this.

The aim here is to:

- Tick off any tasks that have already been completed.

- Delete any tasks that were created but not actually relevant any more.

- Adjust the due date of any overdue tasks, bringing them into the present – Yesterday is gone 👋

If you do not run a process like this, it results in tasks building up and slipping behind. This process helps us all hold each other accountable to make sure we use our Asana to-do list as a guide to running our day and week.

Everyone says ‘no-task-left-behind’ once they are up to date.

4. Agenda building (1-2 word agenda items)

The facilitator will ask the team to raise any agenda items they have, with 1-2 words only for each item. At this stage, we are only noting down the 1-2 word items, no discussions around them.

The team member also needs to specify whether the item is an ‘Update’ or a ‘To Discuss’, and how much time they need (2, 5 or 10 mins).

The difference between these two types of items is important:

- ‘Update’: This is a 1-way communication flow from the team member on something that has changed since the last meeting that they feel the team should be updated on.

- ‘To Discuss’: This is a 2-way communication flow where the team member specifically asks for input they need from the team, either information or a decision.

Once all team members have supplied their agenda items to the facilitator, the facilitator checks the agenda items and expected time required against the remaining meeting time.

If there is a substantial misalignment between the time remaining and the expected time, team members can offer to de-prioritise their items (move them to the bottom) or reduce time.

5. Triage issues (2-way discussion)

Here the facilitator moves down the list of agenda items, specifically calling out each item, the name of the team member who raised it, the time allocated to this item and lastly the question “what do you need?”

The team member then explains explicitly what they need from the team. It is important to get this right because this is the opportunity to let your team know what you want from them before diving into the context.

Examples are:

- “I need to know if we have selected a new supplier for our materials, so I can go ahead and place the order for my project.”

- “I need to know if we can move Tuesdays working session for I have a family member visiting that day.”

By being precise about what you need the relevant team member(s) can offer the information you need or help with a decision for your issue. The aim is not to do specific work in the meeting but to co-ordinate information and support.

Common outputs from an agenda item are:

- Creating or moving a meeting with team members to get the work support needed

- “I need some technical help on the website project, can we put in a 30-minute session to work on that project together? Yes, let’s do Wednesday @14:30.”

- Delegating a specific task to another team member to complete

- “I need more materials for project X, can you order them and let me know when they arrive? Yes, I’ve added a task to order them and will let you know once received.”

- Noting information that allows the team member(s) to continue their work

- “I need to know if we have that new software installed yet before I change the network? Yes, it’s done and you can continue.”

The facilitator has a responsibility to make sure only one item at a time is discussed, and if a decision is required it should be clear on who should decide it. In this way, the agenda item does not become a consensus discussion but moves swiftly to the resolution. Ie. One person is responsible to make the decision, can make that decision or create a task to make that decision. Or similarly, if it’s some form of vote.

Most importantly, the agenda item is done when the person who raised it gets what they needed. If someone else has something they need, they can raise their own agenda item. The facilitator should always have the individual who raised the item in mind and keep checking in with them to see if they got what they needed. Once they have, that item is closed and the facilitator moves on to the next one.

Hopefully, you will get through the agenda in the allocated time. In the beginning, it does take time to learn how to predict the time needed for an item, and discipline to stick to it. As you and your team get used to this type of meeting format, you will easily raise an agenda list with the overall time in mind, self prioritise your issues and graciously roll over the less essential to the next meeting or address it in private communication with the people involved.

6. Closing round (1-way)

With the agenda done, it is time for each team member’s reflection on the meeting.

*Tip: It is best to have laptop screens down and phones away here too.

Nothing is formally required beyond ‘goodbye’, but it is an opportunity to share your overall thoughts on the meeting.

These can be the general feeling (“thanks for the meeting, excited for the projects and week ahead”) as well as constructive insights on how the process served the team today (“we do need to pay attention to the agenda and make sure we stick to the allocated time”).

Remember, it is one way only, so no discussion.

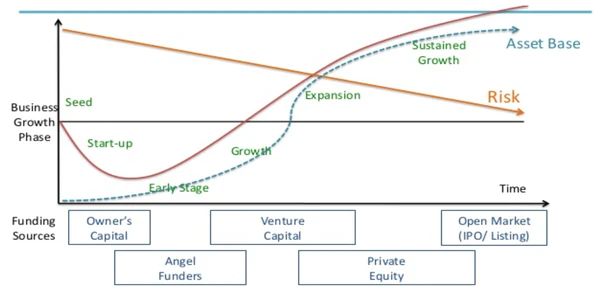

👉Join our Business Continuity Forum for more value-adding and curated content.