Method 2 – The monthly manufacturing process (no finished goods are represented in inventory)

The basic idea behind this approach is to buy in raw materials, and track the quantity and value of those raw materials.

Then when you sell a finished good perform an extra step to reduce the raw materials used in that sale to create the correct cost of sale.

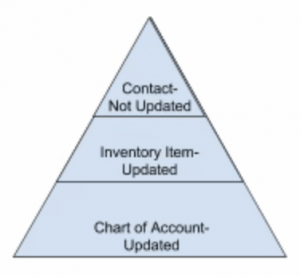

You set this up by:

- Creating tracked inventory items in Xero for all your raw materials

- Creating untracked inventory items for your finished goods (similar to a service item)

The finished good is therefore never actually represented in your inventory. Xero calls this an ‘untracked item’, and it’s treated the same as a service offering in that there is no physical quantity on hand and you can sell unlimited amounts.

You can still see how many of these items you sold but it never shows up on a stock on hand report.

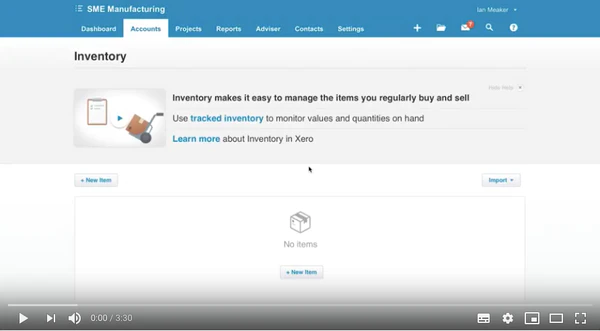

Method 2 Example – see the video here

Click here for Part 2, and Part 3 of the video

You start the month with no stock.

You create the following tracked inventory items for your materials:

- Tricycle frame

- Tricycle wheel small

- Tricycle wheel big

- Tricycle seat

You create the following untracked inventory item for your finished good:

- Tricycle complete

You buy in quantities of tracked inventory items with the following prices:

- Tricycle frame – QTY 6 at R450 each

- Tricycle wheel small – QTY 12 at R50 each

- Tricycle wheel big – QTY 6 at R100 each

- Tricycle seat – QTY 5 at R75 each

As Xero treats this as tracked inventory, you will see these values go directly to your balance sheet under inventory.

You’ll note that this should be enough to make 6 tricycles overall, with 1 frame, 2 small wheels, 1 big wheel and 1 seat used in each assembly. This list is called the bill of materials as if you add up the numbers it should equate to R725 of materials per completed tricycle.

You then manufacture and sell a tricycle.

Note – Xero only allows you to sell these complete tricycles as they are treated as untracked inventory items.

After the sale, you can see the sales amount on your profit and loss but there is no cost of sales. If you check your balance sheet you will see the inventory is still there.

To process the cost of sales we need to do a production invoice to recognise that we have used up the raw materials during the month and sold them in the form of a finished bike.

The sale happens at zero value for all the components but this brings in the cost of sales.

When you do your stock count at the end of the month you should find you have the components for 5 tricycles still on hand. If you manufactured more but did not sell them what you will notice though is that since we are not using a method that allows finished goods to be represented you will see that the finished tricycles are still represented on the stock count as raw materials.

As only the raw materials are represented on your inventory list this method clearly works well when you manufacture to order or don’t hold many finished goods in stock over a month end.

This method is a step up from the stocktake method in terms of cost of sales accuracy as the only manual component now is entering the materials used in the manufacture of the finished goods.

Xero is calculating the average cost of your inventory so you don’t have to estimate the cost of the materials anymore. If you buy some materials at one price and some at another then Xero will keep track of this.

You can perform the cost of sale step after every finished good sale or once a month based on all finished goods sales for that month.

If you need to represent finished goods on your stock count please use Method 3.